Want to master business finance? These 8 books are must-reads for entrepreneurs looking to manage cash flow, budget smartly, and make better financial decisions. Here’s what you’ll learn:

- Cash Flow & Profitability: Books like Profit First and The Lean Startup teach you to prioritize profit and reduce financial risks.

- Investment & Risk Management: The Intelligent Investor and Rich Dad Poor Dad provide timeless strategies for building wealth and managing investments.

- Scaling & Fundraising: Venture Deals and The E-Myth Revisited guide you through startup funding and scaling operations.

- Financial Literacy: Financial Intelligence for Entrepreneurs breaks down financial statements and metrics for smarter decision-making.

Quick Comparison:

| Book Title | Focus Area | Key Takeaway |

|---|---|---|

| The Lean Startup | Reducing financial risks | Test ideas early to save resources |

| Profit First | Profit management | Prioritize profit and control expenses |

| The E-Myth Revisited | Scaling and systems | Build scalable systems for long-term success |

| Financial Intelligence | Financial literacy | Understand and use financial data effectively |

| The Barefoot Investor | Personal finance basics | Simple steps to financial security |

| Rich Dad Poor Dad | Wealth-building mindset | Focus on assets, not liabilities |

| Venture Deals | Fundraising and VC deals | Navigate term sheets and investor relations |

| The Intelligent Investor | Value investing | Disciplined, long-term investment strategies |

These books combine actionable advice with proven principles to help entrepreneurs thrive financially. Ready to level up your financial skills? Start with one of these today!

Top 5 finance books that every entrepreneurs should read ...

How Finance Knowledge Helps Business Owners

Understanding finance can help business owners tackle common challenges more effectively. Here's how:

Better Cash Flow Management

Strong financial skills are key to keeping cash flow healthy - essential for any business. By understanding financial reports and metrics, you can manage receivables, payables, and liquid assets more efficiently. This is especially important during growth phases when cash demands often increase.

"In order to understand how your business is performing right now and to evaluate, assess, and devise new strategies to boost future performance, you need information. Financial statements are a critical source of the information you need." - Richard A. Lambert, Miller-Sherrerd Professor of Accounting at the Wharton School of the University of Pennsylvania [3]

Smarter Investment Decisions

Knowing the basics of finance helps you make better investment choices. As Timothy Ferriss puts it:

"If you can free your time and location, your money is automatically worth 3 to 10 times as much." [1]

This perspective helps entrepreneurs focus on high-return opportunities while carefully managing risks.

Enhanced Fundraising Capabilities

When seeking external funding, financial literacy can make all the difference. A solid grasp of financial concepts not only helps secure funding but also lays the groundwork for sustainable growth.

"Venture capital deals revolve around economics and control." - Brad Feld [2]

With this knowledge, business owners can:

- Understand term sheets

- Negotiate better terms

- Assess valuations accurately

- Manage equity dilution

Strategic Growth Planning

Financial understanding allows for better forecasting and growth strategies. Key metrics to monitor include:

| Financial Aspect | Business Impact |

|---|---|

| Profit Margins | Guides pricing strategies and cost control |

| Operating Costs | Helps allocate resources efficiently |

| Revenue Trends | Informs decisions on expansion timing |

| Working Capital | Determines how fast the business can grow |

Data-Driven Decision Making

Financial literacy turns numbers into actionable insights. By interpreting financial statements, entrepreneurs can:

- Improve revenue streams based on performance data

- Use resources more effectively

- Decide when and how to scale operations

- Evaluate the financial effects of strategic moves

As Karen Berman explains, "Financial intelligence is a learnable skill set crucial for business success" [2]. By developing these skills, business owners can create stronger, more profitable companies and steer clear of common financial mistakes that could hold them back.

How We Chose These Books

To help entrepreneurs strengthen their financial skills, we carefully selected books that provide actionable strategies and practical insights.

Our selection process focused on identifying finance books that offer real value to entrepreneurs. Each title was evaluated using four key criteria designed to address common financial challenges.

Selection Criteria

| Criteria | Description | Weight |

|---|---|---|

| Practical Application | Strategies and frameworks that can be applied | 35% |

| Financial Literacy | Clear explanations of core financial concepts | 30% |

| Entrepreneurial Focus | Relevance specifically for business owners | 20% |

| Reader Experience | Engaging content that's easy to implement | 15% |

Expert Insights

We consulted financial professionals and successful entrepreneurs to ensure our recommendations were well-founded. As Karen Berman and Joe Knight note:

"Financial information is the nervous system of any business."

This perspective shaped our focus on books that strengthen this critical aspect of entrepreneurship.

Key Topics Covered

Each book addresses at least three of the following essential areas:

- Cash flow management

- Profit optimization

- Investment strategies

- Fundraising mechanics

- Financial decision-making

- Business scaling

Focus on Actionable Advice

We prioritized books that provide clear, actionable frameworks. For instance, Mike Michalowicz’s principle - "When profit comes first, it is the focus, and it is never forgotten" - illustrates the type of practical guidance we looked for.

Real-World Impact

We also considered how well each book delivers practical financial guidance that entrepreneurs can use to build a strong foundation for their businesses.

Enduring Relevance

Our list includes both classic and modern works, but every book had to prove its lasting value in addressing financial challenges.

1. The Lean Startup by Eric Ries

The Lean Startup offers a fresh approach to how entrepreneurs handle finances and develop products. With an impressive 4.5/5 rating from over 17,000 Amazon reviews, the book lays out a methodology designed to lower financial risks while encouraging smarter product development [4]. Here’s a closer look at how it reshapes financial strategies for startups.

Core Financial Approach

The book focuses on reducing financial risk through a process called validated learning. Instead of pouring resources into untested ideas, entrepreneurs are encouraged to test assumptions through quick, small-scale experiments. This helps protect valuable startup funds.

"The Lean Startup is a new approach being adopted across the globe, changing the way companies are built and new products are launched." - Eric Ries [5]

Making Financial Decisions

At the heart of the book is the Build-Measure-Learn feedback loop, a process that helps entrepreneurs make smarter financial choices:

| Phase | Financial Impact | Key Advantage |

|---|---|---|

| Build | Low initial investment | Develop affordable MVPs |

| Measure | Spending guided by data | Cut out wasteful activities |

| Learn | Evidence-based decisions | Decide to pivot or continue |

This loop ensures efficient use of resources while guiding decisions on whether to adjust plans or stay the course.

How to Apply It

The methodology focuses on making the most of limited resources by:

- Starting with a minimum viable product (MVP) to gauge interest

- Using data to guide where financial resources should go

"What differentiates the success stories from the failures is that the successful entrepreneurs had the foresight, the ability, and the tools to discover which parts of their plans were working brilliantly and which were misguided, and adapt their strategies accordingly." - Eric Ries [6]

Handling Financial Risks

By following this experimental approach, entrepreneurs can better manage financial risks. The Build-Measure-Learn loop helps avoid expensive missteps, ensuring that funds are spent wisely.

Impact on Startups

This framework reshapes how startups handle finances by prioritizing resource efficiency and encouraging smart, data-driven choices throughout their journey.

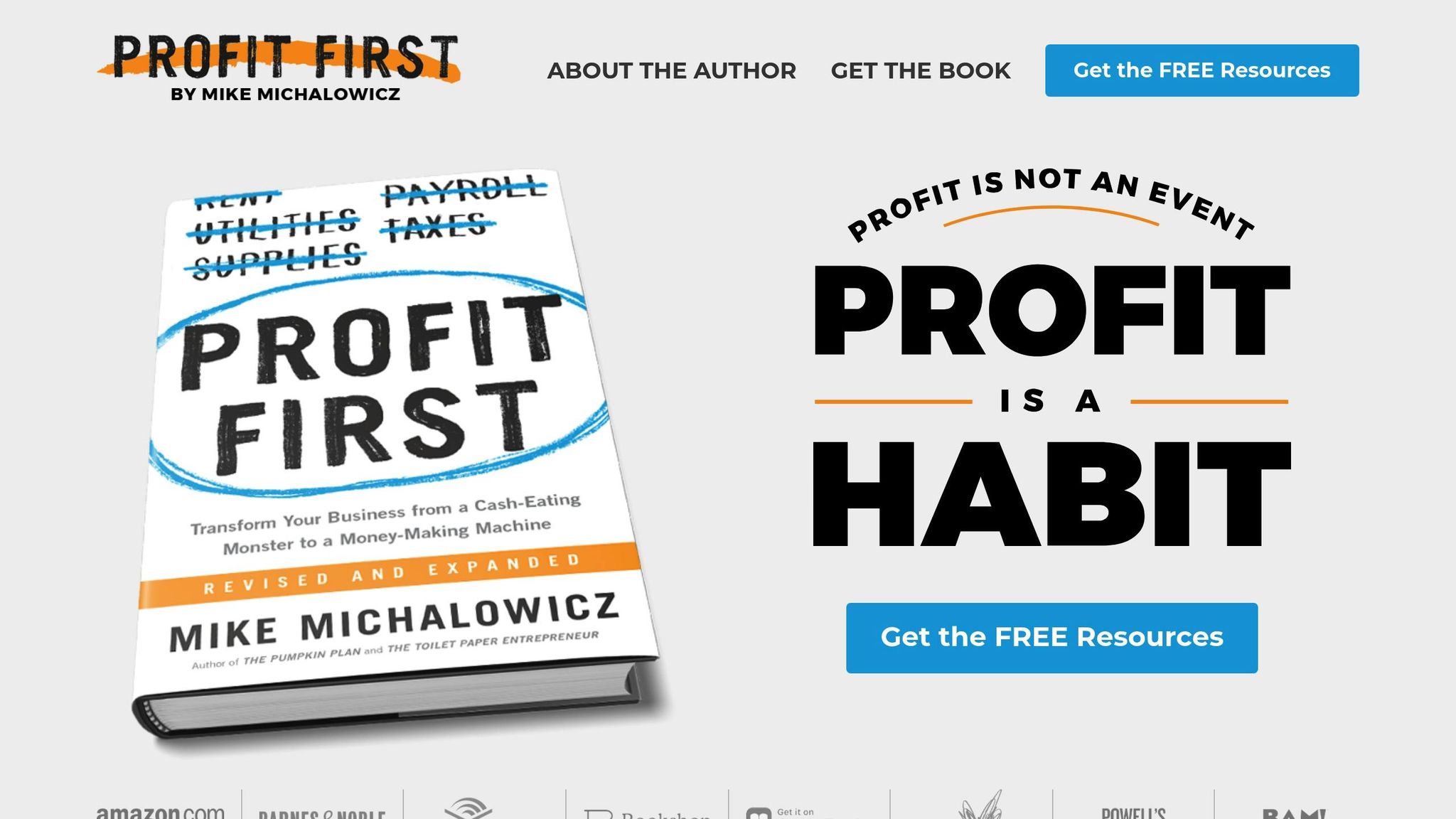

2. Profit First by Mike Michalowicz

Profit First changes the way businesses think about accounting by making profit a priority from the start. Instead of treating profit as what's left over, this system sets aside specific percentages for profit and other key areas right away.

How It Works

The system divides your money into separate accounts, each with a clear purpose:

| Account Type | Purpose | Effect |

|---|---|---|

| Profit | Rewards the business itself | Builds long-term wealth |

| Owner's Pay | Guarantees the owner's income | Provides financial security |

| Tax | Covers tax obligations | Eases tax season stress |

| Operating Expenses | Keeps the business running | Encourages spending control |

Why It Works

This method has been embraced worldwide, showing its success across industries. It turns businesses from struggling to profitable, as Michalowicz puts it, transforming them from "cash-eating monsters to money-making machines" [8].

"Mike Michalowicz is a brilliant business mind. He has an endless stream of small-upside-the-head revelations for entrepreneurs."

- Sally Hogshead, Author of Fascinate [7]

Tools to Get Started

The book doesn't just explain the concept - it provides practical tools to help you apply it:

- Profit First Instant Assessment

- Task Management Forms

- Profit Pod Starter Kit

- Step-by-step implementation guides

These resources make it easy for entrepreneurs to put the Profit First method into action, offering clear steps to improve financial management.

"If there will ever be a patron saint for entrepreneurs, Mike Michalowicz is surely the top contender for the position."

- Simon Sinek, Author of Start with Why [7]

Results You Can See

This approach goes beyond theory. Unlike traditional accounting methods, Profit First uses human behavior to ensure businesses stay profitable while keeping expenses under control.

A New Way to Build Profit

By structuring finances from the start, Profit First helps business owners make profit a reality from day one. It's not just about managing money - it's about reshaping how businesses operate to achieve consistent success.

3. The E-Myth Revisited by Michael E. Gerber

The E-Myth Revisited challenges the belief that technical skills alone are enough to run a thriving business. Michael E. Gerber highlights why 40% of new businesses fail within their first year, and 80% don't make it past five years [9]. The main issue? Many entrepreneurs lack the management expertise needed to effectively grow and scale their businesses.

The Three Business Roles

To succeed, business owners need to balance three key roles:

| Role | Focus | Financial Impact |

|---|---|---|

| Entrepreneur | Strategic vision | Long-term wealth creation |

| Manager | Systems and order | Operational efficiency |

| Technician | Daily tasks | Direct revenue generation |

Most owners spend their time unevenly - about 10% as Entrepreneurs, 20% as Managers, and 70% as Technicians [10]. Understanding and adjusting this imbalance is crucial for long-term success.

Working ON Your Business

Gerber emphasizes a shift in perspective: treat your business as a scalable product. Here's how:

-

Develop Systems

Document processes so your business can operate without your constant involvement. Well-designed systems support consistent growth and financial stability. -

Adopt a Franchise Mindset

Think of your business as a model that could be replicated across multiple locations. This mindset helps you focus on:- Streamlined operations

- Predictable financial outcomes

- A structure that supports expansion

"If your business depends on you, you don't own a business - you have a job. And it's the worst job in the world because you're working for a lunatic!" [10]

Financial Structure

Gerber introduces a detailed plan to align your business operations with your financial goals. This includes:

- Setting personal and business financial targets

- Designing an organizational framework

- Establishing management systems

- Crafting marketing strategies

- Using tools to measure performance

Putting It Into Practice

Gerber's approach provides actionable steps for entrepreneurs:

- Define metrics to track business performance

- Build a company that can run without your daily involvement

- Create repeatable processes for essential tasks

This framework equips business owners with the tools needed to achieve financial stability and set the stage for sustainable growth.

4. Financial Intelligence for Entrepreneurs by Karen Berman and Joe Knight

Financial Intelligence for Entrepreneurs breaks down finance into practical, easy-to-understand concepts tailored for entrepreneurs. Drawing from their experience training Fortune 500 companies, the authors turn what can feel like an intimidating subject into actionable knowledge.

The Balance Between Numbers and Judgment

This book emphasizes that finance isn’t just about crunching numbers - it’s about understanding and interpreting them. The authors break this down into three key areas:

| Financial Aspect | Focus Area | Business Impact |

|---|---|---|

| Investment Evaluation | Calculating ROI | Allocating resources wisely |

| Business Valuation | Assessing company value | Planning strategically |

| Performance Analysis | Interpreting metrics | Making informed decisions |

These areas form the foundation of the book, teaching entrepreneurs how to approach finance with both precision and insight.

Key Financial Skills Every Entrepreneur Needs

The book dives into three crucial financial skills:

-

Reading Financial Statements

Learn how to interpret balance sheets, income statements, and cash flow statements to uncover the financial health of your business. -

Managing Working Capital

Tips on balancing current assets and liabilities to maintain healthy cash flow. -

Analyzing Investments

Tools to assess major decisions using ROI and industry-specific metrics.

Hands-On Learning

What makes this book stand out? Its practical focus. It includes real-world examples from public companies, giving readers the chance to practice with actual business scenarios. This approach ensures the lessons are not just theoretical but directly applicable.

"This book is about financial intelligence - about knowing what the numbers really mean." [11]

Simplifying the Complex

The authors avoid unnecessary technical language, making the book accessible without oversimplifying.

"CFOs who want to promote financial literacy among the non-financial managers they work with might consider recommending this book. It reads easily without dumbing down, and it's comprehensive. It's like The Elements of Style of finance." [12]

A Clear Framework for Decision-Making

Beyond teaching financial skills, the book introduces a framework for analyzing financial reports. Entrepreneurs learn to identify key metrics, uncover the story behind the numbers, and make smarter decisions based on solid data. This framework equips business owners with the tools they need to confidently navigate financial challenges.

sbb-itb-1ae7b2a

5. The Barefoot Investor by Scott Pape

Scott Pape's The Barefoot Investor is a personal finance guide that has resonated with readers looking to take control of their money. Known for its straightforward advice, the book breaks down financial planning into simple, actionable steps. From saving strategies to investment basics, it’s designed to help readers build a secure financial future without feeling overwhelmed.

6. Rich Dad Poor Dad by Robert T. Kiyosaki

Rich Dad Poor Dad shifts the way we think about money. Instead of focusing on traditional money management, it encourages building wealth through income-generating assets rather than being weighed down by liabilities. The book emphasizes the importance of making money work for you, rather than simply trading time for money. Achieving this requires developing a strong mindset to tackle common financial fears.

With over 32 million copies sold worldwide [13], the book inspires readers to overcome fear, procrastination, and bad habits as they work toward financial freedom.

"Wishing will not bring riches. But desiring riches with a state of mind that becomes an obsession, then planning definite ways and means to acquire riches, and backing those plans with persistence which does not recognise failure, will bring riches." – Napoleon Hill [13]

7. Venture Deals by Brad Feld and Jason Mendelson

"Venture Deals" by Brad Feld and Jason Mendelson is a must-read for anyone navigating the world of venture capital. Whether you're a startup founder, an investor, or just curious about how deals are structured, this book breaks down the complexities in a way that's easy to understand.

The authors, both seasoned venture capitalists, share their insider knowledge on topics like term sheets, valuation, and negotiation strategies. The book also provides practical advice on building relationships with investors and understanding the motivations behind their decisions. If you're looking to demystify the venture capital process, this is a great place to start.

8. The Intelligent Investor by Benjamin Graham

"The Intelligent Investor" by Benjamin Graham is often considered a must-read for anyone interested in understanding the principles of investing. First published in 1949, this book has stood the test of time, offering readers timeless advice on value investing and financial decision-making.

Graham emphasizes the importance of disciplined investing, focusing on long-term strategies rather than short-term market trends. He introduces concepts like the "margin of safety" and the difference between an investor and a speculator. These lessons continue to resonate with investors today.

Known as Warren Buffett's mentor, Graham's teachings have influenced countless successful investors. If you're looking to deepen your knowledge of investing fundamentals, this classic is an essential addition to your library.

Book Features Comparison

When comparing books, it's helpful to focus on specific features that can influence your reading experience. Here's a breakdown of key aspects to consider:

- Format Options: Is the book available in hardcover, paperback, eBook, or audiobook? Each format offers a different kind of convenience and experience.

- Page Count: Longer books may provide more depth, while shorter ones are quicker to read and often more concise.

- Genre and Themes: Does the book align with your interests? Whether it's fiction, non-fiction, mystery, or self-help, the genre can set the tone for your reading.

- Author's Style: Some authors are known for their straightforward writing, while others dive deep into descriptive or complex narratives.

- Reader Reviews and Ratings: Checking what others have said can give you a sense of the book's quality and whether it matches your preferences.

Next Steps

Now that you've reached this point, it's time to put what you've learned into action. Take a moment to review the key points, assess your goals, and outline a plan to move forward effectively.

FAQs

How can these finance books help entrepreneurs better manage their cash flow?

These finance books equip entrepreneurs with the tools to understand and manage their cash flow effectively. They provide insights on analyzing cash flow statements, forecasting future cash needs, and identifying trends in cash inflows and outflows. By mastering these skills, entrepreneurs can anticipate potential cash shortages, avoid financial pitfalls, and make smarter decisions about investments or debt management.

With a stronger grasp of cash flow patterns, business owners can optimize their operations, ensure liquidity, and maintain financial stability as they scale their ventures.

What practical strategies do these books provide for entrepreneurs to successfully scale their businesses?

The books featured in this article offer actionable strategies to help entrepreneurs scale their businesses effectively. From mastering financial planning and understanding cash flow to optimizing budgets and securing funding, these resources are packed with insights tailored to the challenges of growing a business.

Key topics include:

- Budgeting and forecasting to ensure financial stability during growth phases.

- Fundraising strategies, including attracting investors and managing capital.

- Scaling operations while maintaining profitability and efficiency.

By applying the lessons from these books, entrepreneurs can make informed decisions and build a solid foundation for sustainable growth.

Why is financial literacy essential for entrepreneurs looking to secure funding, and how do these books help?

Financial literacy is vital for entrepreneurs because it equips them to manage their business finances effectively, evaluate funding opportunities, and confidently negotiate terms. Without a strong understanding of financial concepts, entrepreneurs may struggle with budgeting, cash flow management, or understanding the implications of funding agreements.

These books offer practical guidance on key topics like cash flow, fundraising, and financial decision-making. By breaking down complex concepts into actionable insights, they empower entrepreneurs to make informed choices and build a solid financial foundation for their ventures.